All Categories

Featured

Table of Contents

Insurance policy companies will not pay a minor. Rather, take into consideration leaving the cash to an estate or trust. For more extensive information on life insurance policy get a copy of the NAIC Life Insurance Policy Buyers Guide.

The internal revenue service places a limitation on how much money can go right into life insurance policy premiums for the policy and exactly how promptly such costs can be paid in order for the policy to keep every one of its tax obligation advantages. If certain limits are gone beyond, a MEC results. MEC insurance policy holders may undergo taxes on circulations on an income-first basis, that is, to the extent there is gain in their plans, as well as fines on any taxed quantity if they are not age 59 1/2 or older.

Please note that impressive finances accrue rate of interest. Revenue tax-free treatment additionally thinks the finance will ultimately be satisfied from revenue tax-free fatality advantage earnings. Lendings and withdrawals lower the policy's cash money worth and survivor benefit, may create specific policy advantages or riders to come to be not available and may enhance the opportunity the plan may lapse.

4 This is provided with a Long-lasting Care Servicessm rider, which is offered for an added charge. In addition, there are restrictions and constraints. A client might get approved for the life insurance policy, but not the motorcyclist. It is paid as a velocity of the fatality advantage. A variable global life insurance policy contract is a contract with the main function of giving a survivor benefit.

How can I secure Protection Plans quickly?

These portfolios are carefully handled in order to satisfy stated investment objectives. There are costs and charges related to variable life insurance coverage contracts, consisting of mortality and risk charges, a front-end tons, management charges, financial investment management charges, surrender costs and charges for optional cyclists. Equitable Financial and its associates do not provide legal or tax obligation guidance.

Whether you're beginning a family members or marrying, individuals normally begin to think of life insurance policy when somebody else begins to depend on their ability to gain an income. Which's wonderful, since that's exactly what the death advantage is for. But, as you discover more regarding life insurance policy, you're most likely to locate that several plans as an example, whole life insurance policy have extra than just a fatality benefit.

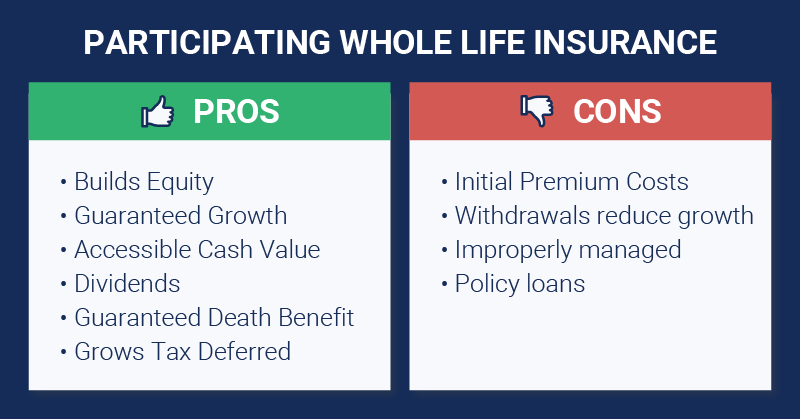

What are the advantages of whole life insurance? One of the most enticing benefits of acquiring a whole life insurance coverage plan is this: As long as you pay your premiums, your death benefit will never ever run out.

Think you don't need life insurance coverage if you do not have kids? You might wish to believe once more. It may appear like an unneeded cost. But there are numerous benefits to living insurance policy, even if you're not sustaining a family. Below are 5 factors why you need to acquire life insurance coverage.

What are the top Accidental Death providers in my area?

Funeral expenses, interment prices and medical bills can add up. Irreversible life insurance coverage is readily available in numerous amounts, so you can select a death benefit that meets your requirements.

Establish whether term or irreversible life insurance policy is ideal for you. As your personal situations adjustment (i.e., marital relationship, birth of a youngster or task promotion), so will certainly your life insurance needs.

Generally, there are 2 kinds of life insurance policy plans - either term or long-term plans or some combination of both. Life insurance companies offer various forms of term plans and conventional life policies along with "rate of interest delicate" products which have actually become extra widespread given that the 1980's.

Term insurance coverage provides defense for a specific period of time. This period might be as brief as one year or provide protection for a specific number of years such as 5, 10, twenty years or to a defined age such as 80 or in many cases as much as the oldest age in the life insurance policy mortality.

What happens if I don’t have Term Life?

Presently term insurance coverage prices are extremely competitive and amongst the most affordable traditionally skilled. It must be noted that it is a commonly held belief that term insurance policy is the least costly pure life insurance policy protection available. One needs to review the policy terms meticulously to determine which term life alternatives appropriate to satisfy your specific situations.

With each new term the premium is boosted. The right to renew the policy without evidence of insurability is an important advantage to you. Otherwise, the risk you take is that your wellness may weaken and you may be not able to obtain a policy at the same prices or also in any way, leaving you and your recipients without coverage.

The size of the conversion period will certainly vary depending on the kind of term policy purchased. The premium price you pay on conversion is typically based on your "current obtained age", which is your age on the conversion day.

Under a level term plan the face amount of the plan continues to be the same for the entire period. With lowering term the face amount reduces over the period. The costs stays the same every year. Frequently such policies are offered as home loan security with the quantity of insurance coverage reducing as the balance of the home loan reduces.

Whole Life Insurance

Typically, insurance providers have actually not had the right to transform premiums after the plan is offered. Since such plans might continue for years, insurers must use traditional mortality, passion and expense price price quotes in the premium computation. Flexible costs insurance policy, nevertheless, allows insurers to supply insurance policy at reduced "current" premiums based upon less conventional presumptions with the right to change these costs in the future.

While term insurance coverage is created to give protection for a specified time period, permanent insurance coverage is made to offer coverage for your entire life time. To maintain the costs rate level, the costs at the younger ages exceeds the real price of security. This extra premium constructs a book (cash money value) which helps pay for the policy in later years as the expense of security increases over the costs.

The insurance policy business spends the excess premium bucks This kind of policy, which is in some cases called money worth life insurance coverage, creates a cost savings element. Money values are vital to a permanent life insurance policy.

Latest Posts

Sell Final Expense From Home

Final Expenses Benefit

Instant Quotes Term Life Insurance